Hey guys, David here. One of the trickiest parts of being a property manager in New York is dealing with tenant damage. Most tenants are great, but every now and then, something goes wrong — a kitchen fire, a burst pipe from negligence, or a flood from someone leaving the tub running. A question I asked my broker early on was: if a tenant causes major damage to the building, am I covered under my property policy?

Here’s what I found out.

In most cases, yes, but it depends on the cause and your policy wording. Standard property insurance covers sudden and accidental damage, no matter who caused it — as long as the damage isn’t excluded and the tenant didn’t do it intentionally. So, if a tenant accidentally starts a fire or leaves a candle burning that causes smoke damage, the policy usually responds to repair the building.

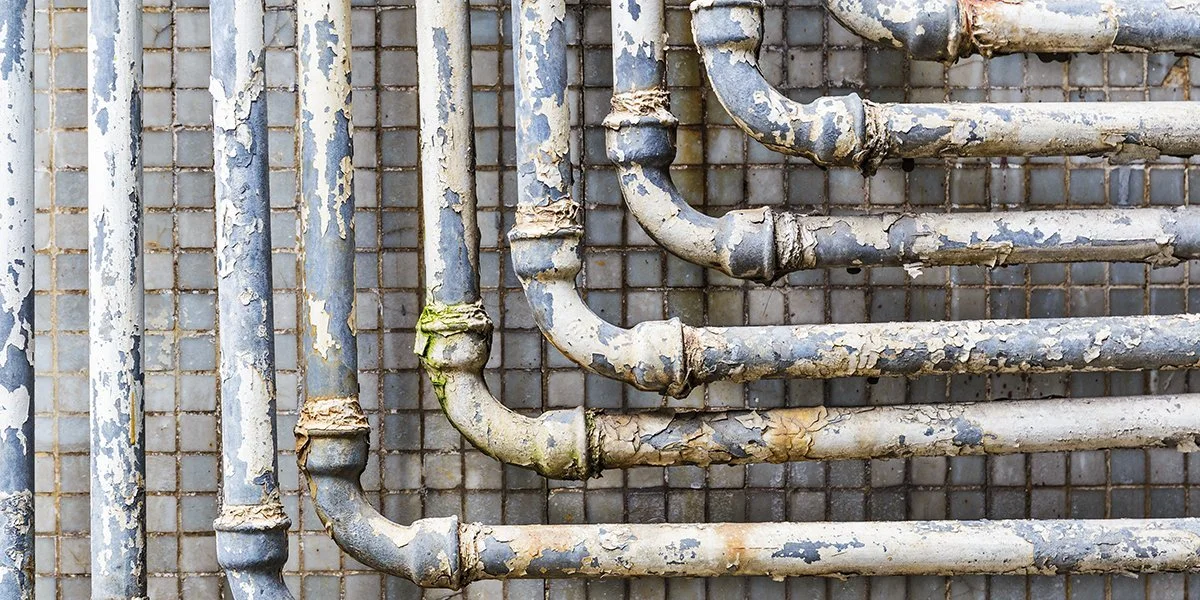

However, things get messy when the damage is due to tenant negligence or long-term issues. For example, if a tenant lets water leak for months, causing rot and mold, that may be excluded as “wear and tear” or “failure to maintain.” Intentional damage (like vandalism by a tenant) can also be excluded, unless you add a vandalism or malicious mischief endorsement.

Another key point — the policy covers the building itself, not the tenant’s personal belongings. Tenants need their own renters insurance for that. But if the damage they cause results in a claim on your policy, you might see a premium increase at renewal.

To reduce the risk, I now make sure every lease requires tenants to carry renters insurance and name the property management company as an additional interest. It’s an easy way to add a layer of protection and prevent finger-pointing when things go wrong.

At the end of the day, most property policies will step in for accidental tenant-caused damage — but it’s always best to double-check your exclusions. And make sure your tenants carry their own coverage too.

If you’d like to review your property policy or add extra protection for tenant-related damage, give us a call at 516-277-0812 or request a quote online: Request a Quote Here.